Study: Brexit could hit salmon export value by 6%

Scottish salmon could experience a decrease in export value of between 4% to 6% in the absence of free trade with the European Union, according to research for the Scottish Government.

The study by ABPmer was commissioned by Marine Scotland to understand possible impacts of Brexit on the seafood sector and examined four hypothetical scenarios for the UK’s exit from the European Union including changes to fishing quota shares and the impact of different types of international trade on the industry.

As well as the impact on salmon exports, the research found:

- All of the scenarios modelled would leave Scotland worse off than the current situation as a member of the EU

- Any increase in fishing quotas would be offset by increasing tariff and non-tariff measures once the UK leaves the European single market and customs union

- Remaining in the single market and the customs union is the least worst outcome for the sector

- Under all of the scenarios Scotland’s aquaculture industry would be negatively impacted

Rural Economy Secretary Fergus Ewing said: “This report confirms that reduced access to EU markets could significantly harm Scotland’s seafood industries, with those parts of our sector reliant on the speedy supply of fresh product to European markets particularly at risk.

“The modelling of these four different scenarios highlights the complexities of Brexit for our seafood industry and in the absence of full EU membership, maintaining membership of the European Single Market and remaining in a customs union is the ‘least worst’ outcome for our fishing, aquaculture and processing sectors.

“The report also suggests that there is unlikely to be an immediate gain for the fishing industry with any quota increases for the fleet only likely to be achieved through international agreement following negotiation over time with coastal state partners, and those economic gains could be reduced through the impact of tariffs on trade.

“We will therefore continue to push to remain in the European Single Market and a customs union with the EU which is essential to protect and support the Scottish seafood sector, both at sea and onshore. We will also reiterate our calls for the UK Government to guarantee that it will not bargain away access to Scottish waters and resources to secure other UK interests.”

As well as including various potential changes in fishing quotas, the scenarios hypothesised four different sets of trading conditions:

- Scenario 1: Removal of all tariffs on UK exports to all countries and the removal of UK tariffs on imports from all countries, and a small reduction of non-tariff barriers between the UK and non-EU trading partners.

- Scenario 2: Tariffs on UK-EU trade flows which are similar to the current EU–Norway agreement, and a modest increase in non-tariff measures between the UK and the EU, while maintaining current (baseline) trade arrangements with the rest of the world.

- Scenario 3: World Trade Organisation ‘Most Favoured Nation’ (MFN) tariffs imposed on bilateral trade between the UK and the EU, together with a larger increase (compared to Scenario 2) in non-tariff measures, while maintaining current (baseline) trade arrangements with the rest of the world.

- Scenario 4: MFN tariffs applied between the UK and EU, and with non-EU countries. Non-tariff measures increase as in Scenario 3, but there is no reallocation of quotas.

The report points out that the scenarios are not predictions of the future “and serve only to highlight the relative importance of the international drivers for the UK seafood sector - level of fishing opportunity, tariffs and non-tariff measures (NTMs)”.

The authors add: “The analysis does not discuss the relative likelihood of any of the scenarios, which are modelled for analytical purposes only.”

The full report can be read here.

In October last year, the Scottish Salmon Producers’ Organisation (SSPO) published a working paper aimed at securing the best possible outcome for the Scottish salmon industry from the UK’s exit negotiations with the EU, amid high level meetings with UK and EU representatives.

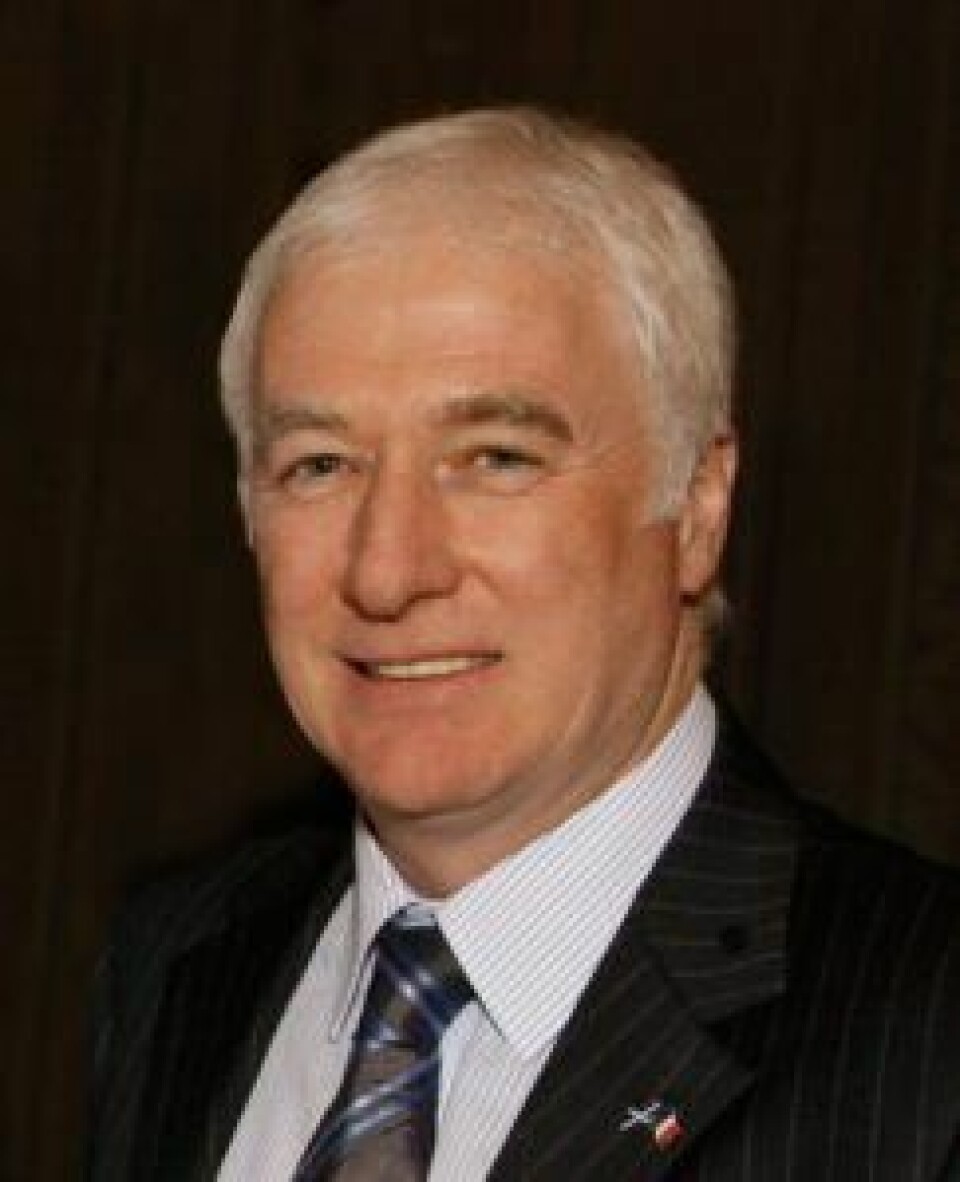

The now-retired chief executive, Scott Landsburgh, said at the time: “In our ideal scenario, the UK and EU would agree a tariff-free comprehensive free trade deal that allows our produce to enter EU markets in much the same way and at the same cost and within the same timeframes as now.

“Then we could move on to taking the potential opportunities that the situation gives us – new free trade deals with other world markets and ideally, a more efficient customs and exporting process. But we are still some way off achieving this as far as anyone can tell.”